Midwest Census Evaluation

(R-Lang, Github, Agile)

Project Overview

In this project, I analyzed the West North Central Division, which includes Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, and South Dakota.

Data Sources

Using data from the U.S. Census Bureau and the CDC’s Social Vulnerability Index, I examined several indicators of vulnerability, including:

. Poverty, unemployment, housing cost burden, education, and health insurance coverage

. Age distribution, disability status, single parent households, and English proficiency

. Racial and ethnic minority populations and language barriers

. Housing types, crowding, and access to transportation

Economic Measures

I also incorporated measures of economic inequality such as median income, home values, and the House Price Index with additional data from the Federal Housing Finance Agency. These indicators provided a way to assess both household well-being and long-term stability in the housing market.

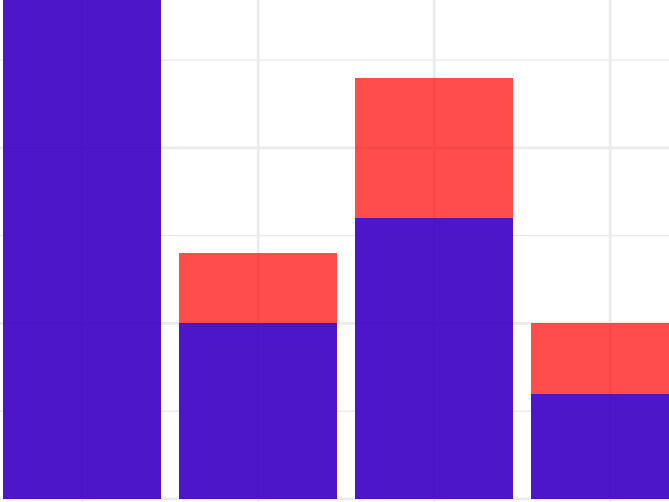

By comparing changes in income and housing values between 2010 and 2020, I was able to highlight where growth aligned with reduced social vulnerability and where disparities persisted. For example, certain metro areas in the West North Central Division experienced steady gains in home values and income growth, while rural tracts lagged behind, signaling widening economic divides. Incorporating the House Price Index allowed me to capture market-level trends, revealing how local housing affordability intersected with broader vulnerability indicators such as poverty and cost burden.

To connect these patterns with federal policy, I evaluated the role of the New Markets Tax Credit (NMTC) and the Low Income Housing Tax Credit (LIHTC), which target high need census tracts through private investment and affordable housing development. The analysis explored whether these programs contributed to reductions in social vulnerability and improvements in economic outcomes between 2010 and 2020.

In the West North Central Division, tracts that received NMTC and LIHTC investment showed modest improvements in median income and home values, particularly in urban centers. However, progress was uneven across the region: rural tracts benefited less, with persistent vulnerability linked to limited access to healthcare, transportation, and affordable housing. These findings suggest that while federal tax credit programs helped alleviate some pressures, their impact varied significantly by location and local infrastructure capacity.

This work was developed as part of a collaborative project, where I contributed my analysis while coordinating with teammates through GitHub for version control and integration.